Huggett (1997): Steady States and Transition Paths in Heterogeneous Agent Models

The Model

We use the seminal work Huggett (1997) to illustrate how the toolbox can be used to solve steady states and transition paths of a heterogeneous-agent model. The example also demonstrates how to conduct non-stochastic simulations using the toolbox, by keeping track of the distribution function over a refined grid of individual state variables.

Though the toolbox is not designed for solving the equilibrium of this type of model directly, since the decision problem is characterized by an equation system (the Euler equation

where \(\lambda_t\) is the Lagrange multiplier on the borrowing constraint, and the complementary-slackness condition, \(\lambda_t k_{t+1}=0\)) with state transition functions, it readily fits in the toolbox’s general framework. One just needs an extra fixed-point loop to update the aggregate equilibrium object, which can be coded in MATLAB. For the one-sector model studied by Huggett (1997), the steady state aggregate equilibrium object is the aggregate capital stock; the transition path aggregate equilibrium object is the time sequence of the aggregate capital stock.

We directly define the equilibrium, which covers all the ingredients we need for computing the model. For the full description of the model, see Huggett (1997) .

A sequential equilibrium is a time sequence of (1) policy functions \(c_{t}(k,e)\), \(\lambda_t(k,e)\), \(k'_t(k,e)\); (2) measures over individual states \(\phi_t\); (3) aggregate prices and quantities \(w_t, r_t, K_t\), s.t.

\(c_t(k,e), \lambda_t(k,e), k_t'(k,e)\) satisfy individuals’ optimality conditions. That is, they solve

Prices are competitively determined and markets clearing:

\(\phi_t\) are consistent with the transitions implied by policy functions and exogenous shocks.

A steady-state equilibrium is a sequential equilibrium with time-invariant equilibrium objects.

Notice we have transformed the individual’s optimization problem into first order conditions and complementarity slackness conditions, which enable us to solve the decision problem with the toolbox.

The gmod File and MATLAB File

1% Toolbox options

2INTERP_ORDER = 4; ExtrapOrder = 4;

3SIMU_RESOLVE = 0; SIMU_INTERP = 1;

4SaveFreq = inf; PrintFreq = 100;

5TolEq = 1e-6;

6% Parameters

7parameters beta sigma kMin r w;

8beta = 0.96; % discount factor

9sigma = 1.5; % CRRA coefficient

10alpha = 0.36; % capital share in production

11delta = 0.1; % depreciation rate

12

13% States

14var_state k;

15kPts = 100;

16kMin = 0;

17kMax = 20;

18kShift = 1e-3;

19k = exp(linspace(log(kMin+1e-3),log(kMax+1e-3),kPts)) - 1e-3;

20

21% Shock process in Huggett (1997)

22var_shock e;

23e = [0.8, 1.2];

24shock_num = 2;

25shock_trans = [0.5,0.5;0.5,0.5];

26

27% Representative-agent steady state

28kSs = ( (1/beta+delta-1) / alpha )^(1/(alpha-1));

29% Initial prices

30r = alpha*kSs^(alpha-1) - delta;

31w = (1-alpha)*kSs^alpha;

32

33% State transition functions

34var_interp Evp_interp;

35initial Evp_interp (k.*(1+r)+e.*w).^(-sigma);

36% Update

37Evp_interp = shock_trans*vp;

38

39% Endogenous variables

40var_policy k_next lambda;

41inbound k_next kMin k.*(1+r)+e.*w;

42inbound lambda 0 1.0;

43

44% Other variables

45var_aux c vp;

46% Used in simulation

47var_output c k_next;

48var_others kSs alpha delta output_interp_t;

49

50TASK = 'ss'; % Default task, need overwritten

51output_interp_t = {}; % Default transition path;

52pre_iter;

53 % The pre_iter block will be called at the beginning of every policy iteration

54 switch TASK

55 case 'ss'

56 case 'transition'

57 t = T - GDSGE_Iter + 1; % Convert forward to backward

58 r = r_t(t);

59 w = w_t(t);

60 end

61end;

62

63model;

64 budget = k*(1+r) + e*w;

65 c = budget - k_next;

66 up = c^(-sigma);

67 [Evp_future] = GDSGE_INTERP_VEC(shock,k_next);

68 euler_residual = -1 + beta*Evp_future/up + lambda;

69 vp = up*(1+r); % Envelope theorem

70

71 equations;

72 euler_residual;

73 lambda*(k_next-kMin);

74 end;

75end;

76

77post_iter;

78 % The post_iter block will be called at the end of every policy iteration

79 switch TASK

80 case 'transition'

81 % The following code constructs function approximation for var_output

82 % and stores in IterRslt.output_interp

83 OUTPUT_CONSTRUCT_CODE;

84 % Store the period-t equilbrium object

85 output_interp_t{t} = IterRslt.output_interp;

86 end

87end;

88

89simulate;

90 num_periods = 1;

91 num_samples = 10000;

92 initial k kSs; % A place holder

93 initial shock 1; % A place holder

94 var_simu c;

95 k' = k_next;

96end;

The MATLAB file that calls the toolbox codes and manually update equilibrium objects main.m

1%% Solve a WarmUp problem

2IterRslt = iter_huggett1997;

3

4%% A fixed-point loop to solve the initial steady state

5tolEq = 1e-5; metric = inf; iter = 0;

6UPDATE_SPEED = 0.01;

7K = IterRslt.var_others.kSs;

8alpha = IterRslt.var_others.alpha; delta = IterRslt.var_others.delta;

9% Non-stochastic simulation, prepare distribution grid

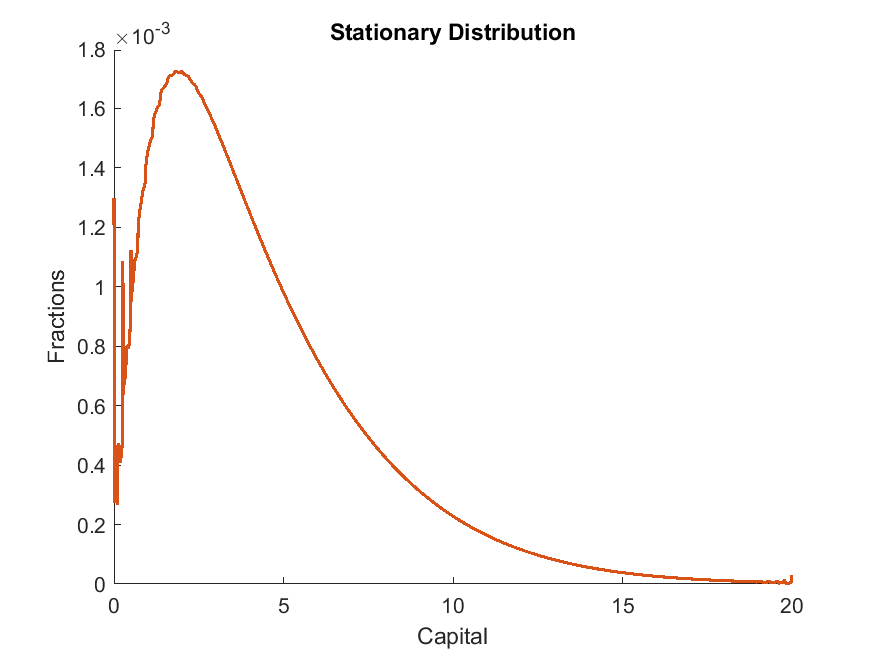

10kFinePts = 1000; shockPts = IterRslt.shock_num;

11kFine = linspace(min(IterRslt.var_state.k),max(IterRslt.var_state.k),kFinePts)';

12kFineRight = [kFine(2:end);inf];

13[kFineGrid,shockGrid] = ndgrid(kFine,1:shockPts);

14% Parameters to simulate only one step

15simuOptions.num_periods = 1;

16simuOptions.num_samples = numel(kFineGrid);

17simuOptions.init.k = kFineGrid(:);

18simuOptions.init.shock = shockGrid(:);

19while metric > tolEq

20 % Solve at prices implied by current K

21 options = struct;

22 options.TASK = 'ss';

23 options.r = alpha*K^(alpha-1) - delta;

24 options.w = (1-alpha)*K^alpha;

25 options.WarmUp = IterRslt;

26 IterRslt = iter_huggett1997(options);

27

28 % Non-stochastic simulation. Simulate one-step to get the state transition

29 % functions over kFine

30 SimuRslt = simulate_huggett1997(IterRslt,simuOptions);

31 % Construct the Markov transition implied by policy functions

32 kp = SimuRslt.k(:,2);

33 [~,kpCell] = histc(kp, [kFine;inf]);

34 leftWeights = (kFineRight(kpCell)-kp) ./ (kFineRight(kpCell)-kFine(kpCell));

35 leftWeights(kpCell>=kFinePts) = 1;

36 rowVec = [1:shockPts*kFinePts]';

37 transToKp = sparse(rowVec,kpCell,leftWeights,shockPts*kFinePts,kFinePts) ...

38 + sparse(rowVec(kpCell<kFinePts),kpCell(kpCell<kFinePts)+1,1-leftWeights(kpCell<kFinePts),...

39 shockPts*kFinePts,kFinePts);

40 % Accomodate the exogenous transition

41 transFull = repmat(transToKp,[1,2]) * 0.5;

42 % Simulate

43 [stationaryDist,~] = eigs(transFull',1,1);

44 stationaryDist = reshape(stationaryDist / sum(stationaryDist(:)),[kFinePts,shockPts]);

45 % Statistics

46 K_new = sum(reshape(stationaryDist.*reshape(kFine,[kFinePts,1]), [], 1));

47

48 % Update

49 metric = abs(log(K) - log(K_new));

50 iter = iter + 1;

51 fprintf('Steady-state iterations: %d, %g\n',iter, metric);

52 fprintf('===============================\n');

53 K = K_new*UPDATE_SPEED + K*(1-UPDATE_SPEED);

54end

55

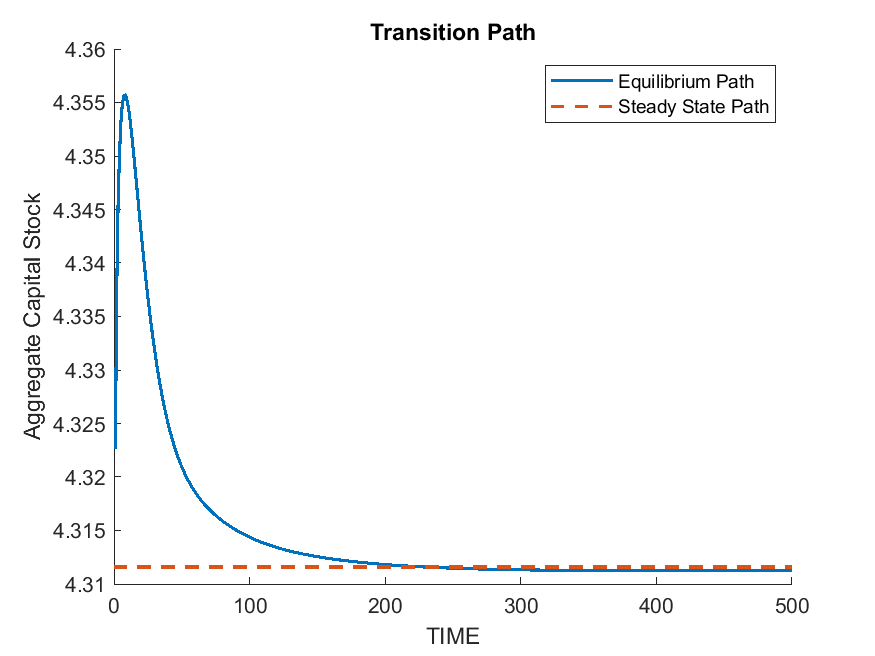

56%% Solve the transition path

57T = 1000;

58K_t = K*ones(1,T);

59K_t_new = K*ones(1,T);

60tolEq = 1e-3; metric = inf; iter = 0;

61UPDATE_SPEED = 0.01;

62% Initial distribution in Huggett (1997)

63dist0 = stationaryDist;

64dist0(1,:) = 0.2/2;

65kBar = K/0.8*2;

66kBarIndex = find(kFine>kBar,1);

67dist0(2:kBarIndex,:) = 0.8 / numel(dist0(2:kBarIndex,:));

68dist0(kBarIndex+1:end,:) = 0;

69while metric > tolEq

70 % Backward loop

71 options = struct;

72 options.TASK = 'transition';

73 options.PrintFreq = inf;

74 options.MaxIter = T;

75 options.T = T;

76 options.TolEq = 0; % Do not check TolEq

77 options.r_t = alpha*K_t.^(alpha-1) - delta;

78 options.w_t = (1-alpha)*K_t.^alpha;

79 options.WarmUp = IterRslt; % Start from steady state

80 options.WarmUp.Iter = 0; % Start with iter 0;

81 IterRslt_t = iter_huggett1997(options);

82

83 % Forward simulation

84 dist = dist0;

85 for t=1:1:T

86 K_t_new(t) = sum(reshape(dist.*reshape(kFine,[kFinePts,1]), [], 1));

87 % Simulate using period-t policies

88 IterRslt.output_interp = IterRslt_t.var_others.output_interp_t{t};

89 SimuRslt_t = simulate_huggett1997(IterRslt,simuOptions);

90 % Construct the Markov transition implied by policy functions

91 kp = SimuRslt_t.k(:,2);

92 [~,kpCell] = histc(kp, [kFine;inf]);

93 leftWeights = (kFineRight(kpCell)-kp) ./ (kFineRight(kpCell)-kFine(kpCell));

94 leftWeights(kpCell>=kFinePts) = 1;

95 rowVec = [1:shockPts*kFinePts]';

96 transToKp = sparse(rowVec,kpCell,leftWeights,shockPts*kFinePts,kFinePts) ...

97 + sparse(rowVec(kpCell<kFinePts),kpCell(kpCell<kFinePts)+1,1-leftWeights(kpCell<kFinePts),...

98 shockPts*kFinePts,kFinePts);

99 % Accomodate the exogenous transition

100 transFull = [transToKp,transToKp] * 0.5;

101 dist = reshape(dist(:)'*transFull,[kFinePts,shockPts]);

102 end

103

104 % Update K_t

105 metric = max(abs(log(K_t) - log(K_t_new)));

106 iter = iter + 1;

107 fprintf('Transition path iterations: %d, %g\n',iter, metric);

108 fprintf('==================================\n');

109 if metric<2e-2

110 UPDATE_SPEED = 0.03;

111 end

112 K_t = K_t_new*UPDATE_SPEED + K_t*(1-UPDATE_SPEED);

113end

114

115%% Plot

116figure; hold on;

117plot(K_t(1:500),'LineWidth',1.5);

118plot([0,500],[K,K],'--','LineWidth',1.5);

119title('Transition Path');

120xlabel('TIME');

121legend({'Equilibrium Path','Steady State Path'});

122ylabel('Aggregate Capital Stock');

123print('transition_path.png','-dpng');

124

125figure; hold on;

126plot(kFine,stationaryDist,'LineWidth',1.5);

127title('Stationary Distribution');

128xlim([0,20]);

129xlabel('Capital');

130ylabel('Fractions');

131print('stationary_dist.png','-dpng');

132

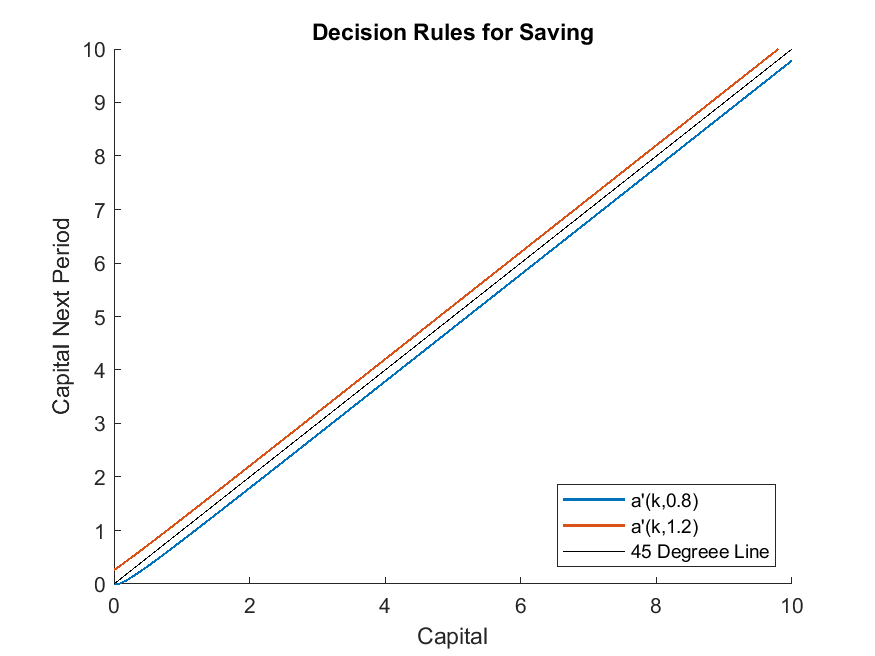

133figure; hold on;

134plot(IterRslt.var_state.k,IterRslt.var_policy.k_next,'LineWidth',1.0);

135plot(IterRslt.var_state.k,IterRslt.var_state.k,'k-');

136xlim([0,10]);

137ylim([0,10]);

138legend('a''(k,0.8)','a''(k,1.2)','45 Degreee Line','Location','SouthEast');

139xlabel('Capital');

140ylabel('Capital Next Period');

141title('Decision Rules for Saving');

142print('policy_function_kp.png','-dpng');

Output

The code produces the stationary distribution

the transition path starting from an equal wealth distribution (see the MATLAB file for how the initial distribution is constructed)

and the policy functions at the steady state.